-

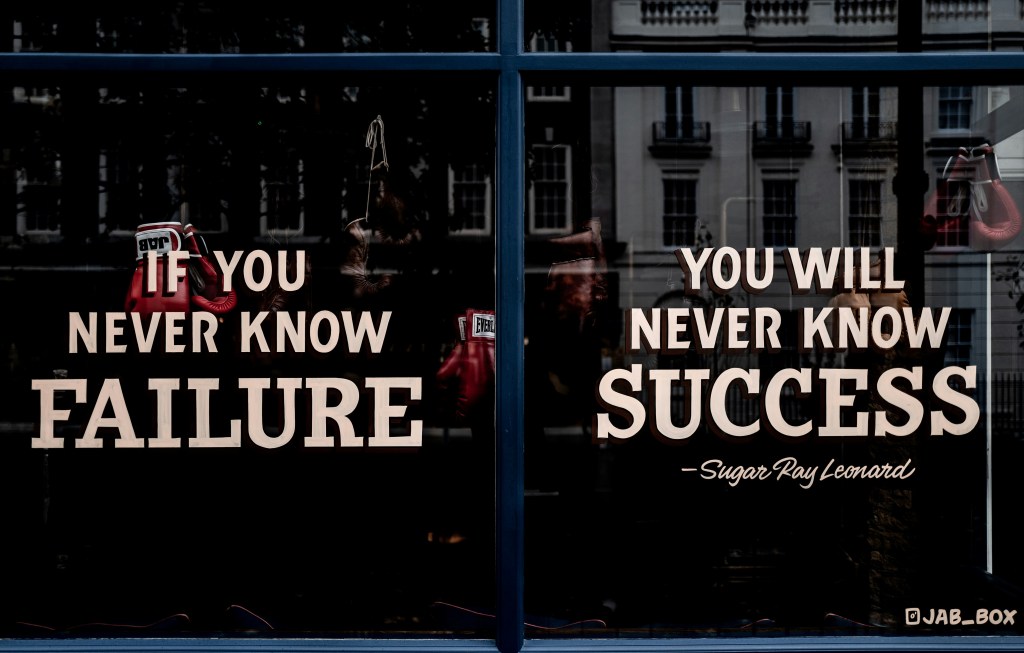

Continue reading →: 2 Lessons from my failed startup

Continue reading →: 2 Lessons from my failed startupI was introduced to a friend recently to share some of my experience running a startup in a similar industry. It did pretty well in the first few years but ended up a failure. There were multiple reasons for the failure but I wanted to share two. Interestingly, there are…

-

Continue reading →: Some Risk is Fun

Continue reading →: Some Risk is FunAs my retirement portfolio is slowly coming into place with my monthly DCAs, I also keep aside some funds to keep myself entertained and have some “fun”. This is my form of barbell approach investing. One side is super stable with a 60/40 allocation in equities and bonds. The other…

-

Continue reading →: My Cash Management tools

Continue reading →: My Cash Management toolsThe conventional thinking of cash management is to have 6-12 months of emergency cash stashed away and the rest right into your retirement portfolio. The cash should be in something liquid like fixed deposits or simply just in high yield accounts. For myself, I have decided on keeping at least…

-

Continue reading →: The Charity Fund Experiment – Results

Continue reading →: The Charity Fund Experiment – ResultsAfter exiting my business a couple of years back, I decided to allocate a small part of my funds to be given away to charity. I read about donor-advised funds but unfortunately did not find something suitable in Singapore. Basically, a fund manager will manage your funds and help distribute…

-

Continue reading →: Don’t Sweat the Small Stuff

Continue reading →: Don’t Sweat the Small StuffIt has been a while since my last post as I was on holiday with my family and also just started playing the game: Black Myth: Wukong. I had wanted to put up at least a post weekly but figured that this is what semi-retired means, I shouldn’t be too…

-

Continue reading →: Rich People Problem

Continue reading →: Rich People ProblemFew days ago, I was speaking to one of my friends who is a lawyer and also comes from a rich family. We spoke a bit about how he and his family does investing and the general feel I got was that they do not believe in the stock market…

-

Continue reading →: Do you have a plan?

Continue reading →: Do you have a plan?I recently read Winning the Loser’s Game by Charles D. Ellis, and he mentioned the importance of having an Investment Policy Statement. I did some digging and found out more on these few links: An Investment Policy Statement will consist of a few basic sections: This interests me as I…

-

Continue reading →: The Big Ugly Event of Our Time

Continue reading →: The Big Ugly Event of Our TimeI first heard this term from JL Collins in his blog post here. In his blog post and book, he described the Big Ugly Event happening in 1929, the mother of all stock market crashes that was the beginning of the Great Depression. Stocks lost 90% of their value during…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.