Few days ago, I was speaking to one of my friends who is a lawyer and also comes from a rich family. We spoke a bit about how he and his family does investing and the general feel I got was that they do not believe in the stock market and do not invest substantially in those. What they prefer to invest in:

- Real Estate (Both residential and commercial)

- Private funds (Participate in IPOs or private rounds of investment)

- Their own businesses

- Just keep in cash

As I speak with more of my well to do friends, this becomes a recurring theme. Some buy individual stocks based on what they like or what is recommended by friends. However, the majority do not touch the stock markets at all. On the contrary, when I speak to my more average achiever friends (sorry guys), they will be more into buying Index ETFs and personal finance stuff.

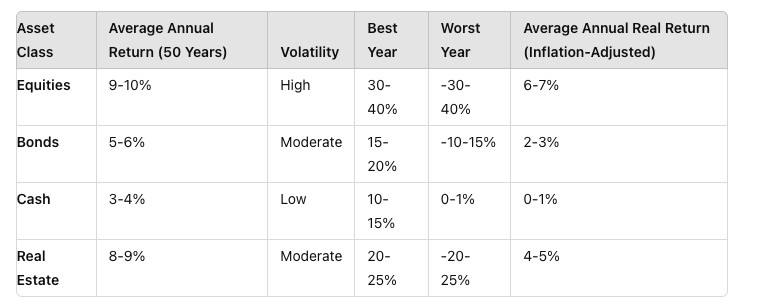

Looking at the performance of asset classes based on the table above, you will think that this is a PROBLEM of the rich friends I mentioned. They are missing out on the higher returns for their cash. I have even seen some data that shows if you were in just bonds and cash, you will be in negative territory.

Putting myself in the shoes of these rich friends, I can think of a few reasons for not investing my money into the stock market. Firstly, I am already earning a big chunk from my businesses/profession. Secondly, I do not want to spend time reading and understanding more on this personal finance topic because I simply do not have any interest. Lastly, I want peace of mind and do not want to worry about the ups and downs of market.

Reasons two and three are kind of interlinked. Because they are not interested in personal finance, they will not read up enough to know or believe that in general, if you buy the whole market using Index funds, it will rise over time. The importance of time in market versus timing the market etc etc…

But, is this really a problem for the rich? It depends on your objective. If the rich’s aim is to be the richest and grow their wealth as big as possible, then it is. By not investing in the stock market, they are missing out on one of the best asset that gives high returns. However, if the rich’s objective is simply to buy the things they want while continuing to grow their wealth without losing too much sleep, then this is not a problem at all.

Some people don’t need to invest and that is fine.

Leave a comment