After exiting my business a couple of years back, I decided to allocate a small part of my funds to be given away to charity. I read about donor-advised funds but unfortunately did not find something suitable in Singapore. Basically, a fund manager will manage your funds and help distribute them to the charity organisations of your choice.

About the same time, I came across this post by Mr Money Mustache. In the post, he highlighted his experience with Betterment (a robo-advisor in the US), and also shared his long term results. I found the post very enlightening and thought I can do something similar for myself using Endowus. I will create my own “Charity Fund” using Endowus and use it to fund my charity goals yearly with a 4% withdrawal. Updates will be posted here quarterly or yearly. Update: Switched from Endowus to DIY from July 2025.

Here is how it works:

- I funded $500k over a few months into two funds: Amundi Prime USA fund (equities) and Amundi Index Global Aggregate Fund (bonds). No particular reason why I chose these two funds other than that they are low cost and also from a reputable company.

- The allocation is based on 80% equities and 20% bonds. Every year in November, I will withdraw 4% in cash out to rebalance the portfolio and donate the 4% cash to the charity organisations of my choosing. I went with the fund smart, Single Fund setup to reduce my fees from 0.5% to 0.3%.

Based on countless research, a 80/20 fund has a high probability to last a long time, so I am hoping that this setup can help fund my charity endeavors in perpetuity. This will be an interesting experiment for me to see if this holds true.

PS: This will also serve as a backup fund for me in case something happens to my retirement portfolio. It is always good to have Plan A, B and C in place.

Why did I choose Endowus?

For my own retirement portfolio, I am doing everything DIY using brokerages and didn’t want to mix my charity funds with it. Although there is some additional fees involved using robo-advisors, in the grand scheme of things, the fee amount is still acceptable.

I have tried a couple of robo-advisors and found Endowus the most well thought out in terms of user experience. Everything went quite smoothly in terms of funding my account. Also, Endowus is well funded and I will expect it to last long enough for my experiment to see some results.

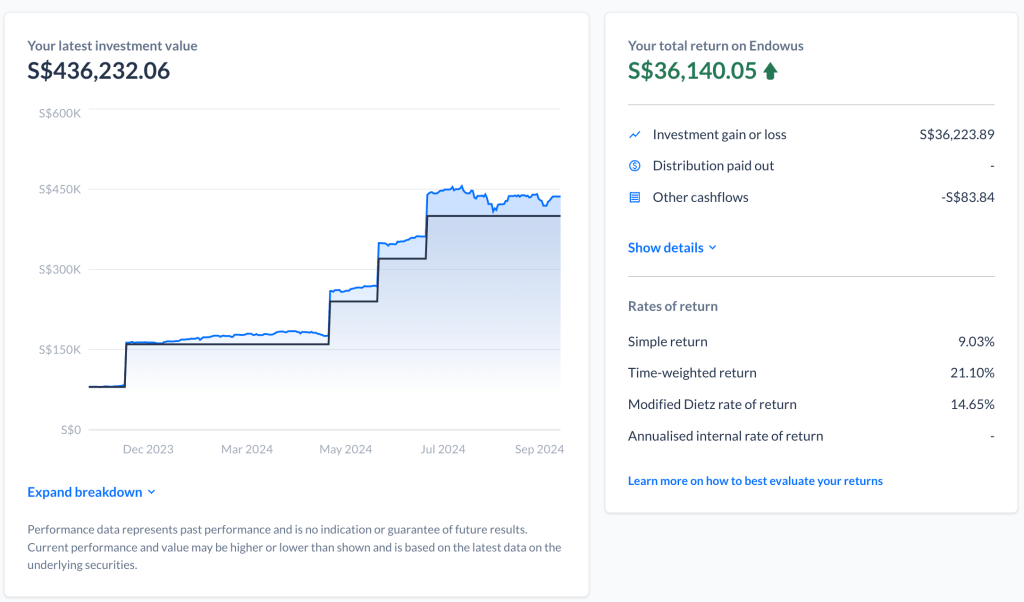

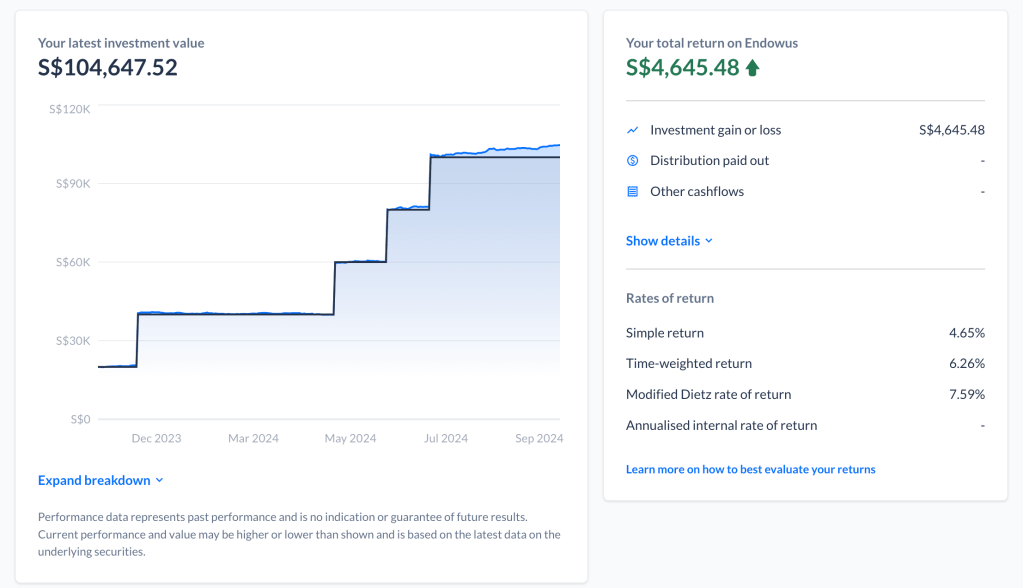

Without further ado, here is the latest performance as of September 2024:

Equities Fund

Bond Fund

Investment in Fund: S$500,000

As of September 2024: S$540,879

The whole stock market has been on the rise in the recent months so I am not surprised by the positive performance. Anyway, I am also mentally prepared for this fund to go negative when the market goes south. I have not done the first 4% withdrawal which is due in 2 months time.

It will be interesting to look back 5-10 years down the road and see how the Charity Fund performs.

Update for end 2024:

As planned, I withdrew S$20k (about 4%) from the Charity Fund in November 2024. The total amount was withdrawn from the equities portion as part of the rebalancing process.

Investment in Fund: S$500,000

As of September 2024: S$540,879

As of January 2025: S$563,770 (4.2%)

With the raging bull market, equities is up big while bonds remains flat. Even after a withdrawal of $20k, the total fund size has increased 4.2% from last tally and we are still overall up from our initial investment. I can’t help feeling that I have missed out on more gains from allocating 20% to bonds. However, it is necessary for the overall portfolio stability.

Update as of July 2025

After some thought, I decided that going DIY is probably the better option for me. The current fees for this setup with Endowus is 0.3% . This is about $1500 a year and if I donate $20k from this fund yearly, the fees is actually 7.5%!

So moving forward, I have redeemed the two Endowus funds and will be purchasing these two new funds for my Charity fund:

- CSPX (Equities)

- AGGG (Bonds)

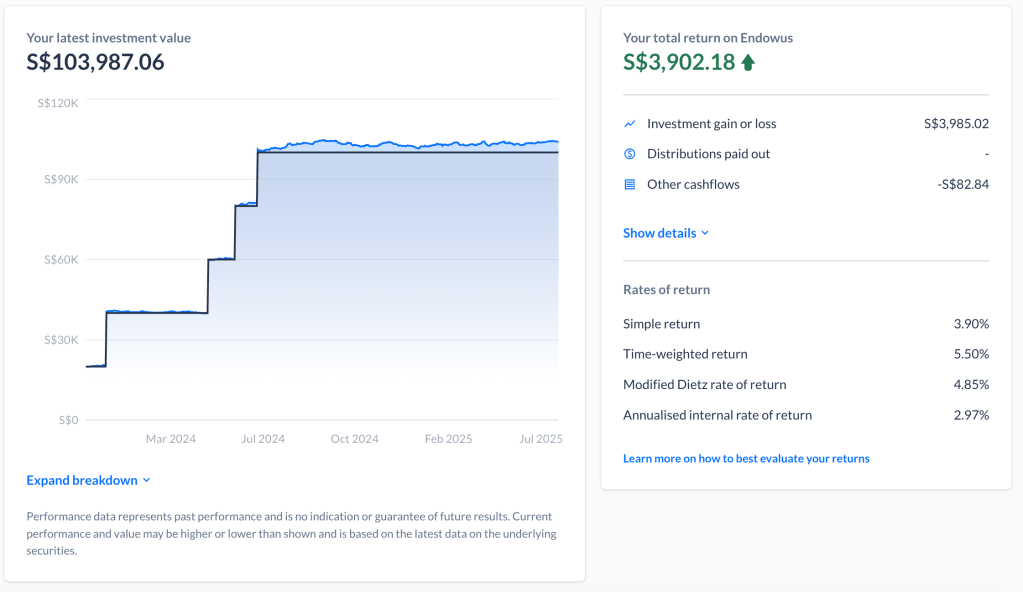

It will still be 80/20 and I will use this chance to rebalance it. Last update from Endowus below:

Investment in Fund: S$500,000

As of September 2024: S$540,879

As of January 2025: S$563,770

As of July 2025: S$565,723

Leave a comment