As my retirement portfolio is slowly coming into place with my monthly DCAs, I also keep aside some funds to keep myself entertained and have some “fun”. This is my form of barbell approach investing. One side is super stable with a 60/40 allocation in equities and bonds. The other side moves up the risk curve drastically with Crypto (for now).

I name this the risky fund portfolio and it is comprised mostly of crypto related assets as I view this as the highest r/r for now. To be honest, I have not delved deeply into other asset classes so this will change.

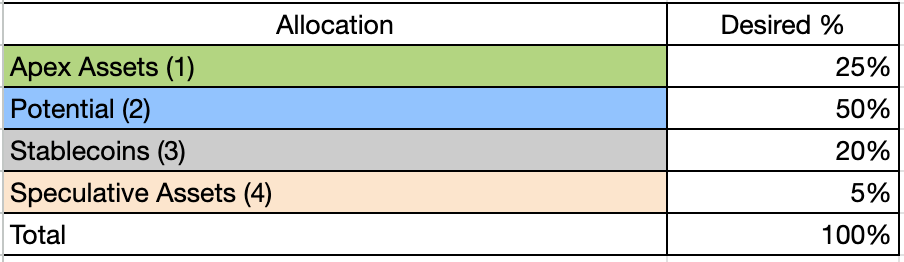

As with the retirement portfolio, I try to have a framework to guide myself in terms of allocation. This is useful for me as there is higher volatility in this portfolio and also more prone to mistakes.

The basic framework here is always keep at least 20% in cash.

- Cash – 20%

- Risky Assets – 80%

You always want to save some bullets and not go full degen. Sanity aside, I keep 20% in cash. This allows me to buy some dips. I can also open up new positions after a big drop.

A deeper look at the breakdown:

Apex assets – assets that I think although risky, will be able to sustain in the long run. Bitcoin is the only asset in this category right now.

Potential – assets that have potential to grow exponentially but yet still have some form of lindy so will not go to zero.

Stablecoins – just the 20% USD that I hold. I purchase mostly Crypto right now so my cash are held onchain.

Speculative Assets – These are assets that might 10x or go to zero.

What to do or not to do:

- Do not use leverage

- Always keep at least 20% cash

- Do not fomo

- Have fun but do not let it affect your sleep

This Risky Fund portfolio is a work in progress and although I am playing with “house” money now, I will still take it slow and not rush into big positions. How high can this go?

Leave a comment